U.S. election cycles are often fraught with volatility and big changes. Nearly every sector and industry is affected in one way or another. Under that framework, investors are forced to grapple with the potential of policy changes, and what they may mean for their portfolio. And for one area of the fixed-income market, the changes could be big.

One clear advantage of municipal bonds could be on the chopping block.

As the incoming Trump administration looks to raise revenues to offset other ambitious tax plans, municipal bonds’ key tax-exempt status could change, which warrants caution from investors.

TCJA Expansion & Potential Deficits

The 2017 Tax Cuts and Jobs Act (TCJA) was the largest tax code overhaul in over three decades and created massive changes for individual and business taxpayers.

Throughout his campaign, President-elect Trump promised to keep most of the TCJA’s provisions intact, while adding additional personal tax savings. This has included removing the current $10,000 limit on the state and local tax (SALT) deduction and eliminating taxes on Social Security and tip income. Trump has also floated the idea of removing taxes on overtime pay.

On the corporate side, Trump has looked into reducing the corporate tax rate further from the TCJA’s 21% limit. This has included dropping it down to 20% for “simplicity” or moving it lower, to 15%, for firms that manufacture goods domestically.

The problem is that these tax cuts have serious long-term consequences in terms of budget deficits. According to the nonpartisan Committee for a Responsible Federal Budget CRFB), Trump’s tax cuts and spending plans would result in an estimated $7.5 trillion deficit over the next decade. Other congressional budget groups and the U.S. Treasury Department have concluded similar deficit analysis, with Trump’s policies adding potentially between $1.45 trillion and $15.14 trillion to deficits.

Munis Get a Target on Their Backs

To make up for the loss in revenue from reducing these taxes and reaffirmations to the TCJA’s provisions, policymakers and President-elect Trump have been looking at various sources — and one of them happens to be municipal bonds.

Since 1913, municipal bondholders have enjoyed interest-free Federal income taxes. The idea behind this tax exemption was to help state and local governments enjoy a lower cost of capital for their funding and borrowing needs. This exemption on interest has long been a key feature of municipal bonds, and they have long been a portfolio holding for many high-net-worth family, insurance, and institutional portfolios.

While the exemption has been as good as gold since the early 1910s, Trump has considered munis and their advantages before.

During the writing of the TCJA in 2017, Congressional Republicans proposed restricting the sale of tax-exempt muni bonds for private sector projects. This would have impacted the high-yield muni market. While that provision wasn’t included in the bill, they did manage to incorporate provisions that eliminated the use of pre-refunding municipal bonds. Here, a state or local government would issue a bond to take advantage of better rates to pay off the proceeds of a bond already coming due.

Heading into 2025, bipartisan support is growing for muni bonds to lose their tax exemption altogether or to change what munis could still qualify for Federal tax exemption. All in all, municipal bond tax exemptions are seriously considered a way to raise revenue.

Investor Caution Is Warranted

For municipal bond investors, the idea that these bonds could lose their main selling point is pretty dramatic. If Congress and President-elect Trump do in fact remove the tax exemption, it will change how state and local governments fund their operations, build infrastructure and, essentially, govern. S&P Global estimates that more states will be forced to issue taxable munis to pay for projects, increasing the burden on taxpayers.

Moreover, the total amount of funds the government would receive from removing the exemption is only around $40 billion. While not insignificant, it is still a rounding error when looking at a potential tens of trillions’ worth of budget shortfall.

With that in mind, many pundits are betting that widespread muni exemption stays in place. And even if the exemption is taken away, many pundits estimate that already-issued bonds would be grandfathered in, providing existing tailwinds to their demand amid the shrinking supply.

In fact, many of the issues that changes to the TCJA and additional tax cuts would create could potentially spur higher taxes down the road. This would cause a significant tailwind for municipal bonds and their high after-tax yields.

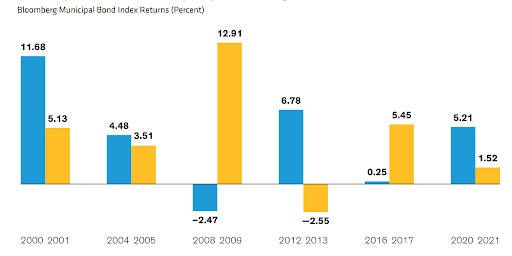

To that end, caution in the muni sector is warranted. But investors may not want to give up on their municipal bonds just yet — particularly when munis have enjoyed positive returns in the election calendar year and the following year. The two outliers in this chart from AllianceBernstein were the 2007-2008 financial crisis and the ‘taper tantrum.’

Source: AB.com

Municipal Bond ETFs

These funds were selected based on their exposure to municipal bonds at a low cost. They are sorted by their YTD total return, which ranges from 1.9% to 3%. They have expense ratios between 0.05% and 0.65% and assets under management between $1.2B and $37B. They are currently yielding between 2% and 3.6%.

| Ticker | Name | AUM | YTD Total Ret (%) | Yield (%) | Exp Ratio | Security Type | Actively Managed? |

|---|---|---|---|---|---|---|---|

| FMB | First Trust Managed Municipal ETF | $1.9B | 3% | 3.2% | 0.65% | ETF | Yes |

| MUNI | PIMCO Intermediate Municipal Bond Active ETF | $1.47B | 2.7% | 3.6% | 0.35% | ETF | Yes |

| MUB | iShares National Muni Bond ETF | $36.8B | 2.2% | 3.0% | 0.05% | ETF | No |

| VTEB | Vanguard Tax-Exempt Bond ETF | $34B | 2.2% | 3.2% | 0.05% | ETF | No |

| SUB | iShares Short-Term National Muni Bond ETF | $8.7B | 2.1% | 2.12% | 0.07% | ETF | No |

| SHM | SPDR Nuveen Bloomberg Short Term Municipal Bond ETF | $3.9B | 2.1% | 2.2% | 0.20% | ETF | No |

| DFNM | Dimensional National Municipal Bond ETF | $1.23B | 1.9% | 2.2% | 0.19% | ETF | Yes |

For investors, it’s perhaps best to stay the course with munis. A state government’s strong budgets and its own hefty rainy funds make the sector a strong choice for fixed-income investors — tax exemption or not. Just remember that changes could be brewing, and investors may not want to bet the entire farm on a portfolio of munis just yet. Investors need to know more about Trump’s tax policy and what’s in store for the sector.

Bottom Line

Municipal bond’s one key advantage — their tax exemption — is once again getting a hard look from policymakers as budget deficits grow and they look to fill potential revenue voids. That throws some cold water on the sector. However, investors may not want to give up on munis just yet.