Municipal bonds continue to be a core component of fixed-income portfolios, especially given their tax-advantaged income and historically low default rates. But the 2025 landscape introduces a set of different risks and opportunities for both investors and issuers. As the rate cycle turns, fiscal pressures evolve, and the political climate remains fluid, municipal bond market participants must reassess their risk and reward appetite to better understand the evolving environments.

In this article, we will take a quick look at a few key points that are likely to evolve and impact the municipal debt markets for the duration of President Trump’s presidency.

1. Potential Rate Cycle Reversal: The Return of Duration and Opportunity

Investor Perspective:

After an aggressive tightening cycle that saw the Fed Funds rate peak above 5%, the Federal Reserve is signaling a potential shift toward easing as inflation moderates and economic growth decelerates. This pivot could present a potential re-entry point into longer-duration municipal securities, which stand to benefit from duration-driven price appreciation as rates come down. The steepening of the yield curve, particularly the normalization of the front end, will enable investors to capitalize on the price appreciation of long-duration bonds purchased at higher coupons, relative to where the markets may be headed.

In this context, tax-equivalent yields on high-grade municipal bonds remain attractive relative to corporate counterparts, particularly for investors in high marginal tax brackets.

Issuer Perspective:

Municipal issuers, many of whom delayed issuance amid high borrowing costs in 2023–24, are expected to reenter the market to fund their large capital ecosystems. For example, for utility infrastructures, including water, wastewater, and stormwater, cities or special districts may start to look at the right time to issue debt to finance the heavy construction costs of system upgrades, expansions, or new builds. This is also true for many transportation agencies looking to expand their systems with federal and state grants, paired with system contributions from debt issuances.

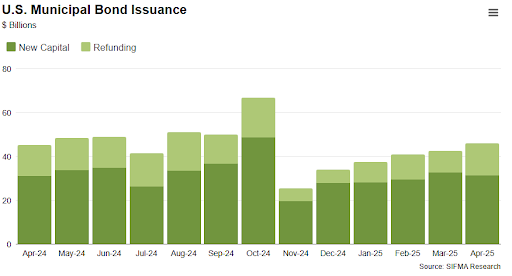

The chart below, by Securities Industry and Financial Markets Association (SIFMA), shows the following trends in the issuance and refunding of municipal debt by issuers in both calendar years 2024 and 2025.

However, not all issuers will benefit equally. While AAA and AA credits will enjoy a more favorable cost of capital, lower-rated entities may still face tighter market access and wider spreads, especially in a risk-off environment.

2. Credit Quality and Fiscal Health: The Strength of Underlying Revenue Sources

Investor Perspective:

As discussed in the prior articles, not all municipal debt issuances are created the same. It is important for Investors in 2025 to be increasingly focused on credit fundamentals, especially in the wake of pandemic-era federal aid tapering off. States like Texas and Florida, with robust tax bases and population growth, are viewed favorably. On the other hand, jurisdictions facing pension liabilities, shrinking populations, or revenue volatility — such as Illinois or certain Northeast cities — are under heavier scrutiny by rating agencies. Like any investment vehicle, active management and credit research remain key in the current and upcoming credit landscape.

Issuer Perspective:

Issuers with diverse revenue sources, strong balance sheets, and transparent fiscal policies will likely benefit from lower spreads and easier market access. Conversely, those with deteriorating fiscal conditions may face higher borrowing costs or even difficulty accessing capital markets altogether. ESG (Environmental, Social, and Governance) metrics are also playing a larger role in both investor appetite and issuer disclosure standards, especially around climate risk and social equity.

3. Tax Policy and Political Risk

Investor Perspective:

Municipal bonds’ tax-exempt status continues to be one of their biggest draws, particularly for high-net-worth investors. However, ongoing discussions in Washington about potential changes to the tax code, especially concerning the treatment of wealthy individuals, could impact demand. If the cap on state and local tax deductions is lifted or federal income tax rates rise, demand for tax-exempt income could surge. For example, if Congress allows the 2017 Tax Cuts and Jobs Act (TCJA) provisions to expire at the end of 2025.

For high-income investors in high-tax states like New York, California, or New Jersey, the after-tax value of municipal bond interest would increase significantly. For instance, if the top federal rate moves back to 39.6% and the investor is also subject to a 3.8% Net Investment Income Tax (NIIT), the tax-equivalent yield on a 4% tax-exempt muni jumps to roughly 7.3%, making municipals highly competitive relative to taxable corporates and Treasuries. This would likely trigger a demand surge in the top-tier tax-exempt muni market.

Issuer Perspective:

Policy uncertainty remains a double-edged sword for municipal issuers. On one hand, increased investor demand due to higher tax rates could lower issuance costs. On the other hand, reduced federal support or regulatory shifts — like potential curbs on private activity bonds — could constrain capital-raising strategies. Issuers and all parties involved in facilitating the municipal debt transactions may look at other interim funding sources like bank credit facilities, and maintain their watch on how the tax policies unfold. The funding needed for large projects will still likely follow the traditional debt structures of longer-duration debt.

Bottom Line

The U.S. municipal bond market in 2025 presents both challenges and opportunities. Investors must navigate a nuanced environment shaped by interest rates, credit dispersion, and policy volatility. Issuers, meanwhile, are entering a more favorable rate cycle but must contend with investor skepticism and evolving fiscal expectations. For both sides, discipline, transparency, and adaptability will be key to success.